Table of Contents

Vendor (or better “Extended Workforce”) Management Systems are proven means to transform the procure-to-pay lifecycle for contingent labor and services into a fully digitized process to achieve operational excellence, reduce costs, enhance quality and foster compliant and transparent supplier collaborations. This article will guide you through the process to demonstrate the financial and non-financial benefits to achieve a substantial return on investment (ROI) for a VMS.

1. Mapping your current spend & processes

Most companies figure out: The question “Who makes up your extended workforce?” cannot be answered right away. Getting the full picture requires significant effort in ERP data extraction, spend analytics and data cleansing.Basically, you will need to apply the spend cube framework on your ERP data extract:

1. Categories (What) 2. Suppliers (Who) 3. Cost centers (Where) to outline:

- Approximate relevant spend under management

- Split by type of spend (Temp, Contractors, SOW, SLA, ….)

- Split by category of spend (IT, Legal, Consulting, HR, Marketing, …)

- Type and # of workers (SOWs, T&M, Shift-based workers, …)

- Locations, business units and cost centers impacted

- Suppliers by spend and category, contracts

- Skill sets and roles in demand

A starting point could be to identify the current population of temporary employees, contractors and suppliers. Look for the following information:

a. Temps / Contractors

- Name

- Work Location

- Start Date

- Hourly Rate

- Skill category (Job title or job category)

- Hiring Manager (Location, department, division, organization)

b. Service Providers

- Name

- Location

- Category (IT, Admin, …)

- Coverage (Local, regional, national, global)

- Pricing (Market benchmarks, mark-up, rate cards)

Moreover, operating models, processes, policies and IT systems need to be taken into consideration. Examine the current process used to procure contingent labor and services, define the desired processes and identify the resources necessary to close the gaps.

Since VMS programs are usually cross-organizational it is important to assemble a committee of stakeholders from diverse functions to walk through the current as-is processes. Typically, your stakeholder committee should include representatives from:

- Hiring manager community (Key hiring managers, department heads)

- Procurement

- Human Resources

- Legal

- Finance

- Executive sponsor

Start the mapping of the as-is process with the hiring managers. As the process unfolds, each stakeholder will identify how they interact with the process.The complete process should include:

- Requesting and describing work needing to be done (by the hiring managers)

- Determining the right type of engagement (Temp, T&M, SOW)

- Compliance check procedures

- Approvals

- Identifying suppliers

- Notifying suppliers about the request

- Receiving and reviewing candidates/resumes or proposals

- Evaluating candidates (based on interviews) or proposals

- Selection of a candidate/proposal

- Creating a purchase order

- Background investigations, security, onboarding

- Time sheet or SOW fee entry, submission and approvals

- Supplier invoicing and payment

- End of engagement procedures

Map the entire process along with comments and notes regarding exceptions, specific requirements and time estimates per step. Create a similar map and narrative to describe your desired process that reflects your goals like automation, transparency, cost & risk reduction, quality improvements and shorter cycle times.

2. Defining goals & objectives

As a next step it needs to be clarified which high level organizational goals and objectives should be addressed and which specific benefits are expected. Typically, the benefits of using Vendor Management System technology can be clustered into one or more of the following categories:

- Efficiency gains (Less manual work via automation and shorter cycle times)

- Risk reduction

- Cost savings

- Quality improvements

Examples include:

a. Reduction of maverick buying

- Consistent approach on engaging external workers and service providers

- Increased user compliance to preferred suppliers / contracts

- Empowerment of stakeholders to source autonomously with full compliance and transparency

- Improved hiring manager experience: Real-time labor decisions, contractual recommendations and best-practice RFP templates

b. Regulatory and internal policies compliance

- Reduction of workforce costs by correct/optimized work(er) classifications

- Avoidance of personal criminal liability, fines, back taxes, firefighting costs, loss of reputation

- On-demand availability of all documents, approvals, signatures and more

- Meaningful insight into all activities across the project timeline with easy access to greater detail

c. Automation of manual burdens

- Near touchless sourcing process through self-serve model, templates and contractual recommendations: Hustle free journey from request to engage, including supplier matching and intelligent routing

- Improved collaboration internally and with outside parties that drive better outcomes and higher quality firm relationships

- Reduced time spent on repetitive, administrative tasks – More time for high-value work

- Automated spend reporting and real-time tracking of cost, quality and risks

- Quicker approvals for requests, work orders, modifications and time sheets

- Quicker invoice approval and processing time to take advantage of early pay discounts

d. Full visibility and enhanced decision-making

- Central access to accurate, consistent and comparable real-time data across all external services and workers

- Automated reporting and analytics

- Data-driven decision-making including panel reviews and negotiations

- Fairer, competitive and comparable proposals

- Visibility of work in progress – no need to wait for the invoice: Tracking and reporting on budgets, improving accuracy of forecasts over time

- Merit, skill and experience-based supplier and candidate matching

- Like-for-like comparison and review of rates, work and value for money

e. Reduction of time-to-start

- Faster approvals due to increased avenues provided via email

- Faster, broader distribution of RPFs and job posting with just a few clicks

- Side by side comparison of proposals and benchmarking with past orders

- Automated triggering of process flow with reminders

f. Increased compliance to negotiated rates

- Automated enforcement of rates and billing guidelines

- Rate card management based on company-specific job taxonomies and service catalogues

- Cost of a worker or deliverable measured against internal or market benchmarks (by location, skill set, level, …)

- Contractual recommendations (e.g. lower bill rates for roles/workers via staffing companies instead of SOW)

g. No overpayments

- Transparency into costs and payments per PO line item and resource including record of all revisions

- Highly structured work order data incl. intercompany cost allocations and task codes

- Engagement recommendations (e.g. use of milestone-based pay instead of T&M)

- Invoice import and matching to the appropriate suppliers, cost centers and project

h. Increased quality of work

- Improved service from partner suppliers and reduced effort through supplier rationalization

- Configurable 360 degree surveys for teammates, suppliers and stakeholders. Or keep it simple: NPS and 5 star rating

- Real-time insights to respond quickly if issues surface

- Option to implement rewards or performance-based fee arrangements

i. Audit readiness & GDPR compliance

- Master worker records of both suppliers, SOW and contingent workers in one place

- Guided digital on- and offboarding processes

- GDPR-compliant tracking of assignments

- Prevention of loss of (decentral) data and unauthorized access with enterprise grade security & data protection

3. Cost-benefit analysis

Using the data from your spend mapping exercise you should create a report showing the total relevant spend and include totals by supplier, departments/hiring managers, service categories and service subcategories, skills and job titles in demand. This report should highlight the following:

- How is the spend distributed among suppliers? Would moving to fewer suppliers give you enough leverage for volume discounts?

- What are the average rates offered by suppliers in the same categories? Could you save money by moving away from more expensive suppliers?

- What is the spend by hiring manager/department? Could you save money by bundling demand and exchanging experience? Are the buying processes similar?

- What is the spend distribution by skill category? How much could you save by implementing rate cards?

- What is the average assignment length? Longer assignment lengths generally lead to increased rates. Are there assignments running > 1 year (causing potential compliance risks)?

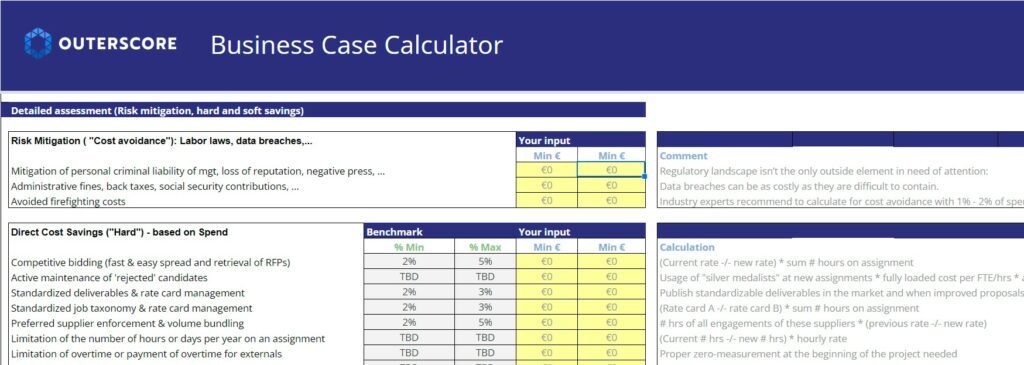

Use the as-is process you mapped to identify soft cost savings. Determine the average time a hiring manager spends from initial request to contract start. Determine the average cost of a hiring manager (with internal burden applied) and apply that to the average spent for all active hiring managers. Look for business cases for companies similar in size which include pre and post program spend figures along with ongoing savings. Return on investment of using VMS technology is easy to prove as many benefits are directly related to lowering costs. To estimate the benefits we have developed a business case calculator which can be downloaded.

4. Pricing models for Vendor Management Systems

The most common pricing models for VMS technology are:

- Supplier-funded models: The industry standard. Roughly 2/3 of all VMS systems in place (mainly in the US) are funded by suppliers. In essence, the suppliers using the tool are charged a fee per transaction based on the overall anticipated volume of annual transactions processed through the buyer’s VMS.

- Transaction-based models: Also tied to the anticipated annual usage (spend) managed via the system – but financed by the buyer.

- Fixed SaaS fee models: A flat fee paid on a set schedule (e.g. annually) based on the company size (revenue or spend). Allows organizations to determine a specific cost.

Depending on the chosen model, the annual spend volume and spend type (contingent or SOW) the VMS fees vary between 0,3% and 0,9% of the spend managed via the system. Additional one-off implementation fees might occur for customizations of such as data migrations, integrations and training of internal and external users. Under the supplier-funded model, suppliers pay neither the buyer nor the VMS provider a per transaction fee outright. The fee is deducted from their invoices based on the agreed-upon bill rate. The amount paid by the supplier is a small percentage of the savings they achieve by having more transparency into the buyer’s decision-making processes, the more efficient transaction of RFPs and orders and analytics provided by the system. To prevent spikes in supplier rates during the VMS implementation process benchmarking and continual rate card analysis are conducted. Even if a supplier would increase bill rates to cover the VMS usage fee of e.g. 0,7% the impact would be minimal considering the buyer’s anticipated overall cost savings and improved quality control.

5. Download VMS Business Case Template

We’ll provide you with an Excel-based tool to calculate the potential savings that a Vendor Management System could bring your organization.